Pay Faster Next Time

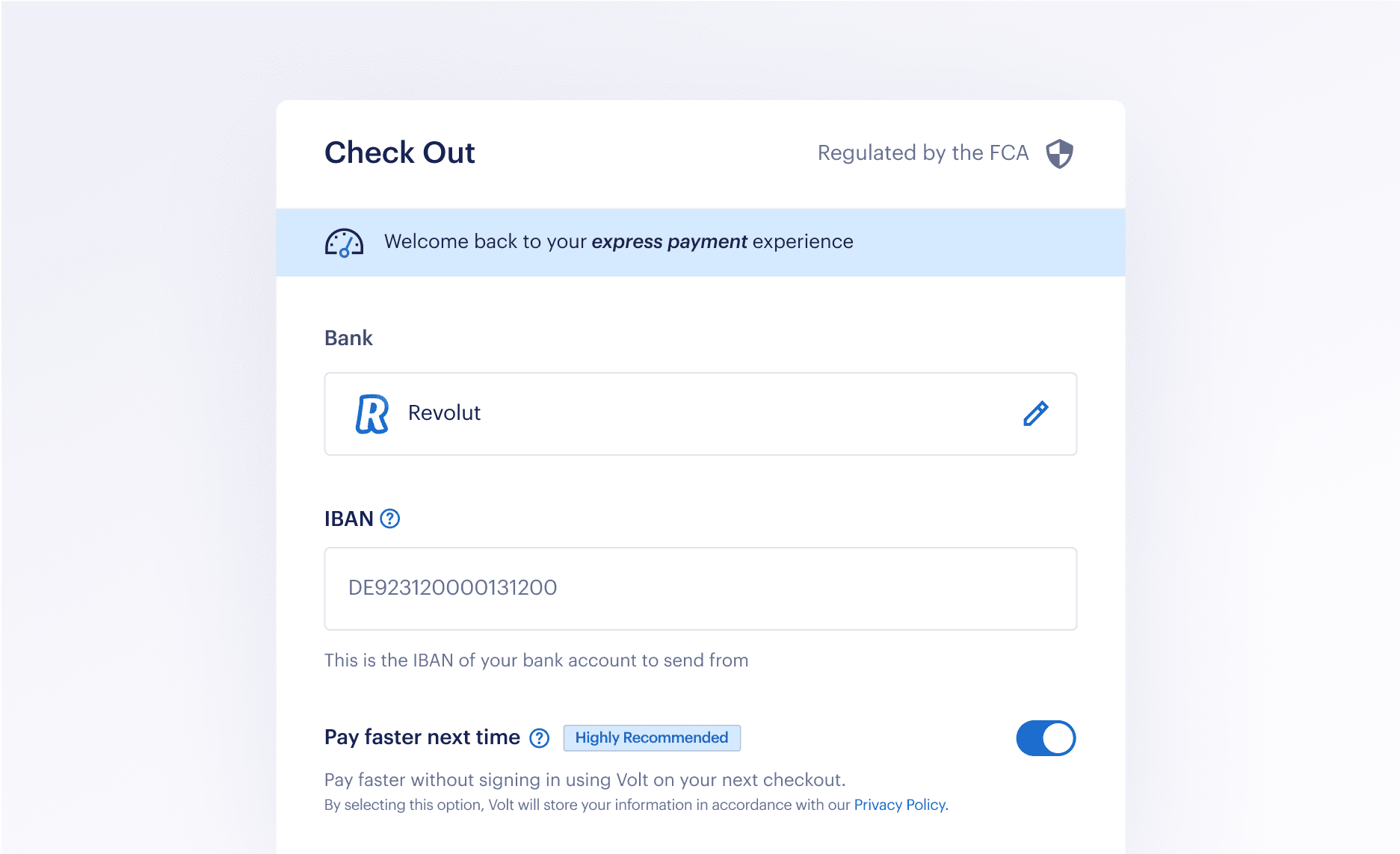

Some banks need more info from your shopper before they can approve the payment. For example their account number or IBAN. To save your shopper time, Volt Checkout offers the option to save their details during our checkout. If the shopper returns, the details are already filled out and the shopper only has to confirm and continue. The details are kept safe on our servers and are only used for payments to the original merchant. If your shopper buys from somewhere else, we won’t have their details.

We use the shopper.reference field from payment request to identify returning shoppers. When Volt recognises the shopper based on the shopper.reference, the shopper will see the Volt Checkout already filled out and is ready to continue.

Volt only requires the shopper.reference to recognise returning the shopper. But we recommend also providing first name, last name and email address for heightened security. This data is also used by Circuit Breaker for fraud prevention.

Which information is stored?

We store all details which we can to reduce friction for the shopper. This includes, account numbers, IBANs, bank or branch codes. We will not store data which is considered as access credentials, e.g. usernames or passwords.

The shopper must explicitly agree to their information being stored by selecting an opt-in checkbox. If a shopper doesn’t select the box, or subsequently deselects it, their details will not be saved or removed.

One-click payments in Australia

For our Australian shoppers, we have introduced a feature called one-click payments, which allows the shopper to approve a payment agreement for recurring payments. This feature speeds up and simplifies the checkout process for returning shoppers. We use the shopper reference to initiate payments authorised by Volt, without needing to approve agreements again in their bank.

How it works

-

One-Click Payments: Shoppers can opt-in to save their payment details for future transactions. Once the shopper has approved the initial payment agreement, future transactions can be completed with a single click. The initial payment agreement allows for making recurring transactions.

-

Returning Shopper Identification: We use the

shopper.referencefield to identify returning shoppers. If the shopper is recognised based on theshopper.reference, they will see their details already filled out in Volt Checkout and can proceed with one-click. The payment is authorised by shopper with PIN or embedded biometrics which makes the journey feel more secure for the shopper. -

Data Storage and Security: All necessary payment details, such as account numbers and bank codes, are securely stored on our servers. This data is only used for payments to the original merchant, ensuring privacy and security.

By implementing one-click payments, Volt aims to provide a seamless and efficient checkout experience for returning shoppers in Australia, reducing the need for repeated approval processes and enhancing overall user satisfaction.

- On this page

- Pay Faster Next Time

- One-click payments in Australia