Payment and bank references

Volt Checkout operates with 2 references related to the payment.

uniqueReferencemain reference forwarded to the shopper’s bank for the payment initiation andmerchantInternalReferenceadditional references stored at Volt’s side, not forwarded to the banks.

These references are often used to identify to the payment across the payment journey for the shopper and the processing systems, e.g. payment ids, order ids, merchant name or product names. However, the main purpose of these references for Volt is to allow for a reliable identification of the payment. Volt strongly suggests to use the uniqueReference for reconciliation before choosing to add other information to it.

Limitations of references

If you are familiar with Open Banking, you know that the uniqueReference is the payment reference used to initiate the payment at the shopper’s bank. The constraints are not imposed by Volt Checkout but by the banks. For Volt Checkout to ensure the payment is initiated correctly and the reference is passed on without being changed by the banks, it is limited to the most commonly used length for the reference.

Find more details about the references in the payment requests.

What does the shopper see on their statement?

Shoppers see Volt payment details during the checkout, when authorising the payment and after the payment was completed in their online banking (mobile, web and other places) or on their bank statement. Volt Checkout shows the uniqueReference to the shopper before they complete the payment. The payment authorisation, online banking and bank statement are services provided by the shopper’s bank and therefore the bank ultimately determines which information is presented. The following table shows the most common data points displayed to the shopper in these services.

| Shopper’s bank statement / online banking | |||

|---|---|---|---|

| EU/UK | Brazil (Pix) | Australia | |

| Volt API data point | |||

uniqueReference |

Yes | No | Yes |

merchantInternalReference |

No | No | No |

shopper.reference |

No | No | No |

additionalDescription |

N/A | No | Yes |

| Other data points | |||

| TPP, e.g. Volt Ltd | Rarely | Yes | No |

| Beneficiary name, e.g “Merchant Ltd.” | Yes | Yes, always “Volt” | Yes |

| Beneficiary account number, e.g. IBAN | Yes | Yes | No |

| Merchant Name (as a separate field) | N/A | Yes | Yes |

| Volt’s payment reference (only for PIX) | N/A | Yes | N/A |

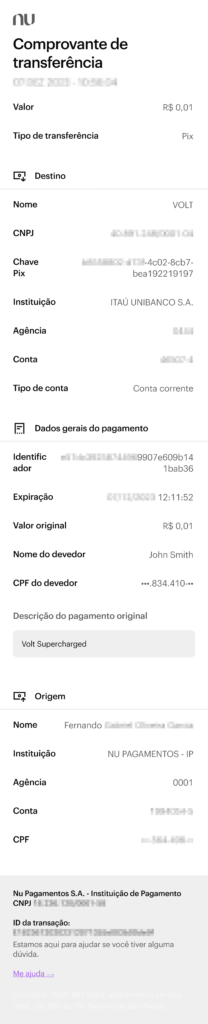

Brazil example

This is how a Volt payment via PIX shows in the mobile banking in Brazil. This is an example from one bank and other banks might show different details. It shows

- Amounts

- Dates and times

- Beneficiary (Destino) details

- Payment details including the Volt payment reference (Identificador)

- Merchant name (here “Volt Supercharged”)

- Originator details including name and bank account details

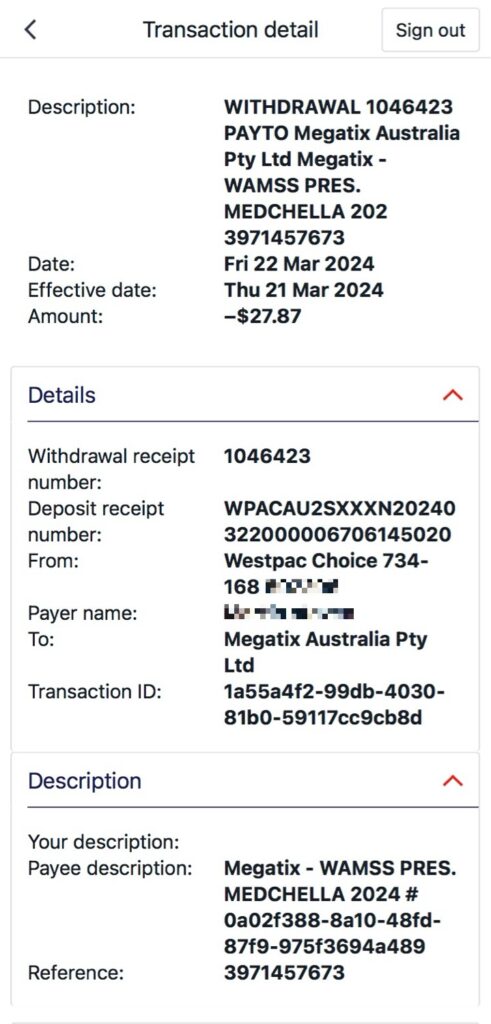

Australia example

This is an example of a payment made under a PayTo agreement in Australia, based on the Westpac online banking. Other banks may be formatted differently but will generally contain the same information.

It shows

- The amount (as a debit in this case)

- Dates (but no times)

- Payment details including the unique reference and the extended description

- Merchant name (here “Megatix Australia Pty Ltd”)

- Payer (shopper) details including name and bank account details

- Internal references for the bank