Volt checkout

There are two options for our checkout.

Embedded

Available in: 🇦🇺 AU, 🇪🇺 EU, 🇬🇧 UK

In the embedded one, the Volt checkout is integrated so that it appears to be part of your website.

Hosted

Available in: 🇧🇷 BR, 🇪🇺 EU, 🇬🇧 UK

In the hosted checkout flow, the user is redirected to a separate checkout page, hosted by Volt.

Key features of both checkouts

- Clean and responsive UI

- User-friendly, conversion-optimised bank search

- Automatically prompts for bank-specific requirements (IBAN, account number etc.)

- Express checkout: opt-in-based simplified flow for returning payers. More information can be found here

- Easy setup

Embedded checkout

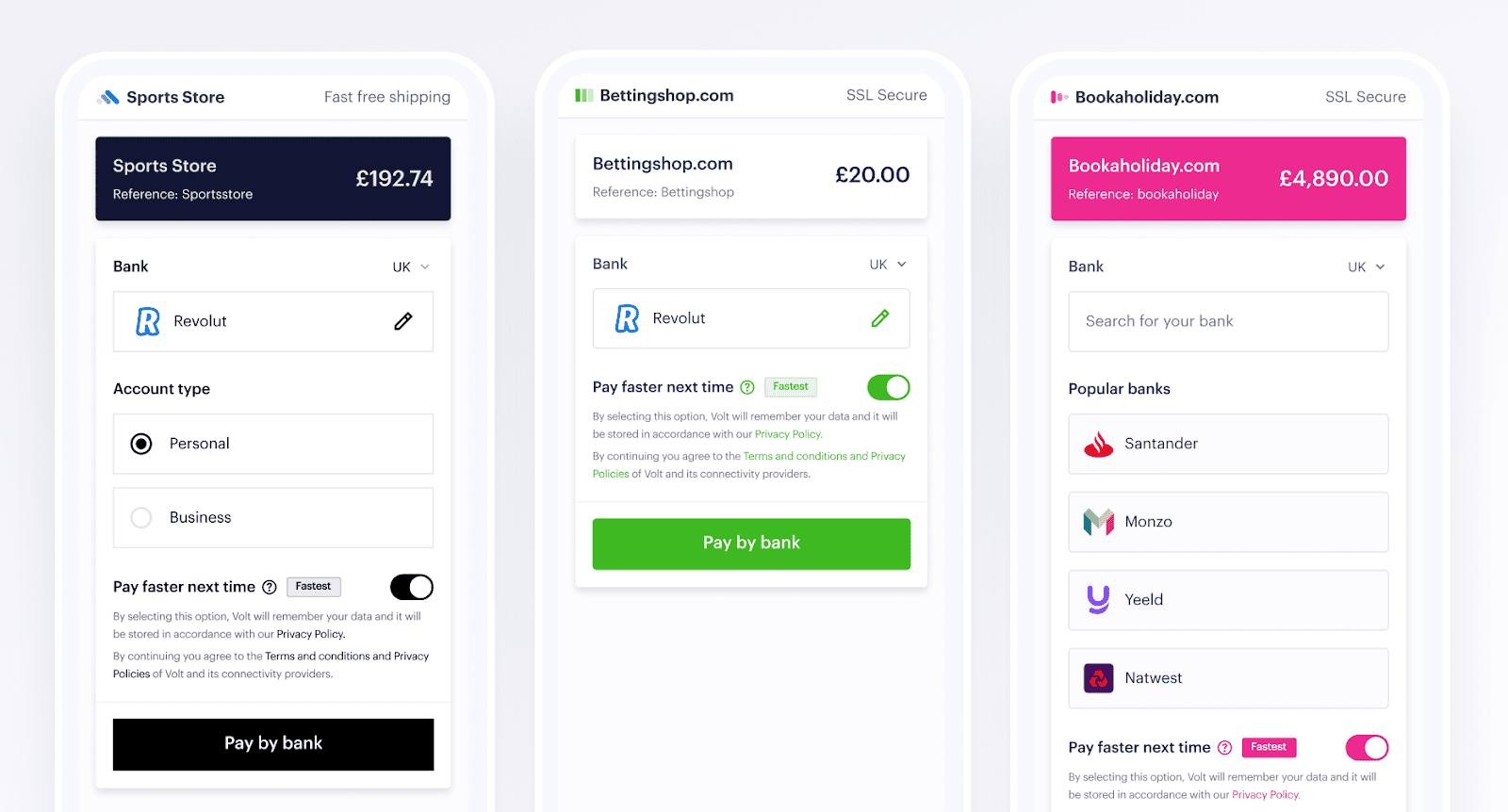

Embedded checkout is a beautiful and customisable pre-built user experience, which allows the payer to choose their bank and start the payment process while still on your website. You have control over the background, font and icon colours and choose the language the Volt checkout is displayed in, so we’ll fit right in with your branding.

Increases conversion

As there are fewer redirects than our hosted checkout, you can increase your conversion and reduce payer abandonment rates.

Approve at the bank

Once the payer has reviewed the details of the payment, they will be redirected to their online bank to authenticate and approve the payment.

Some bank customers may need to provide additional details such as the account’s IBAN, a customer identification number, a two-factor authentication code or even login credentials in order to proceed with the payment. If credentials are required, we’ll redirect to our checkout where we’ll securely collect this information before finalising the payment.

Hosted checkout

On our hosted checkout, you can either leave everything to us or start the bank selection process as part of the checkout or user profile on your own website.

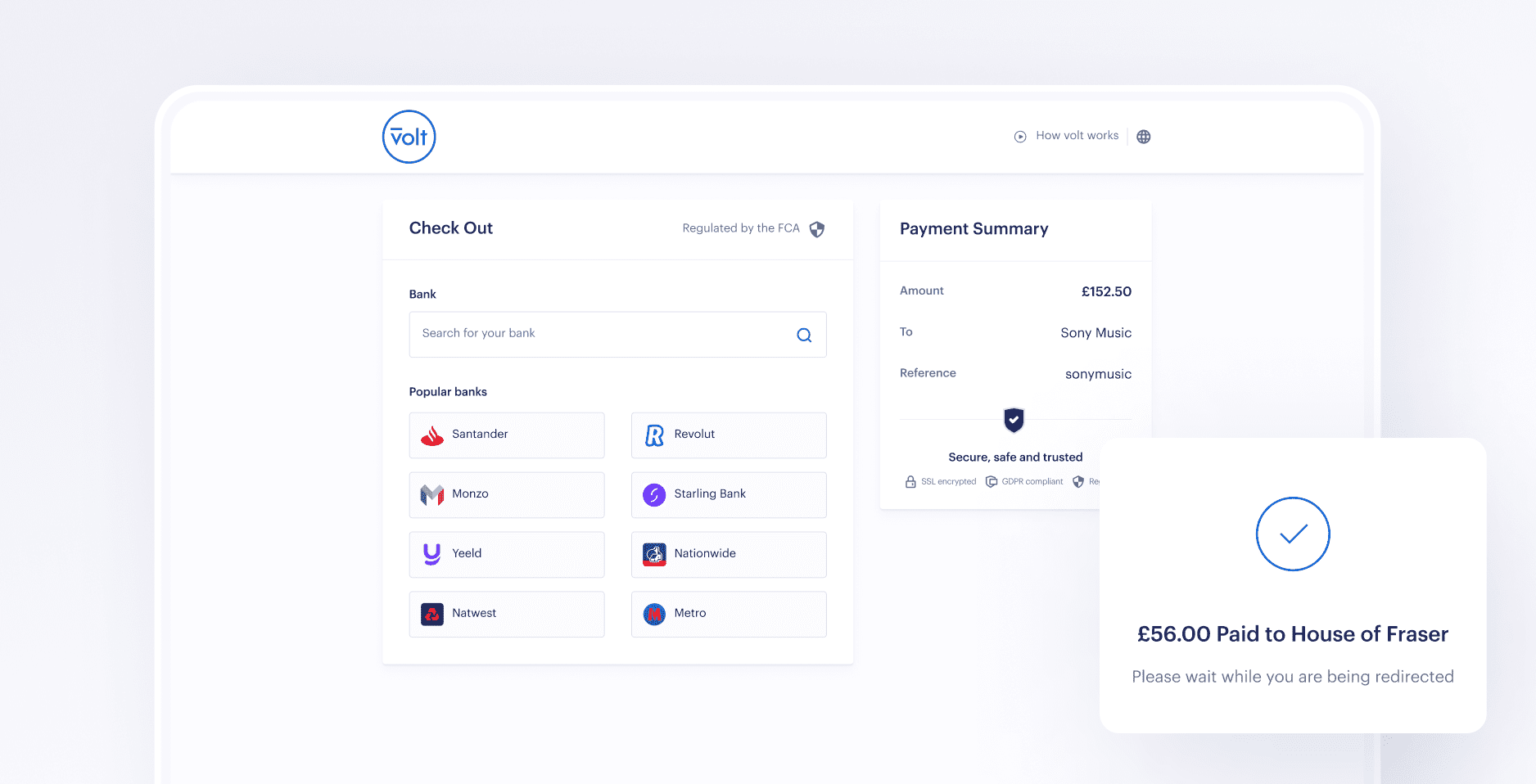

Leave it all to us

Our hosted checkout is the simplest solution to implement, requiring a single API call after authentication, where the payer chooses to use Volt’s Pay by Bank service on your website before you redirect them to a checkout page hosted by Volt.

Here, the payer can use our conversion-optimised bank search and input any other data that may be required in advance. They can also take advantage of our express checkout option and retain their bank information for future payments.

Tell us the bank to use

Our simplified experience relies on you to tell us which bank the payer would like to use, before you redirect them to Volt. We then display a clear confirmation page showing the details of the payment.

You can display a list of banks for the payer to choose from, as an integrated part of your own checkout process or stored as part of their user profile on your site. As part of our API, we provide an up-to-date list of banks with logos and icon marks for each one, to enable you to create a beautiful bank selector.

On either page

Once the payer has reviewed the details of the payment, they will be redirected to their online bank to authenticate and approve the payment. If the payer is using a mobile device and they have their bank’s app installed*, the app should open and they can login and approve the payment.

Some bank customers may need to provide additional details such as the account’s IBAN, a customer identification number, or a two-factor authentication code in order to proceed with the payment.

Returning the customer to you

Once the payment is complete, your customer will return to your website or mobile app.

* requires that the bank app is fully compatible with open banking payments.

- On this page

- Volt checkout

- Embedded checkout

- Hosted checkout