Hosted checkout

The hosted checkout integration provides a ready-to-use payment page hosted by Volt. It offers a quick and secure way to start accepting payments without extensive development efforts.

Leave it all to us

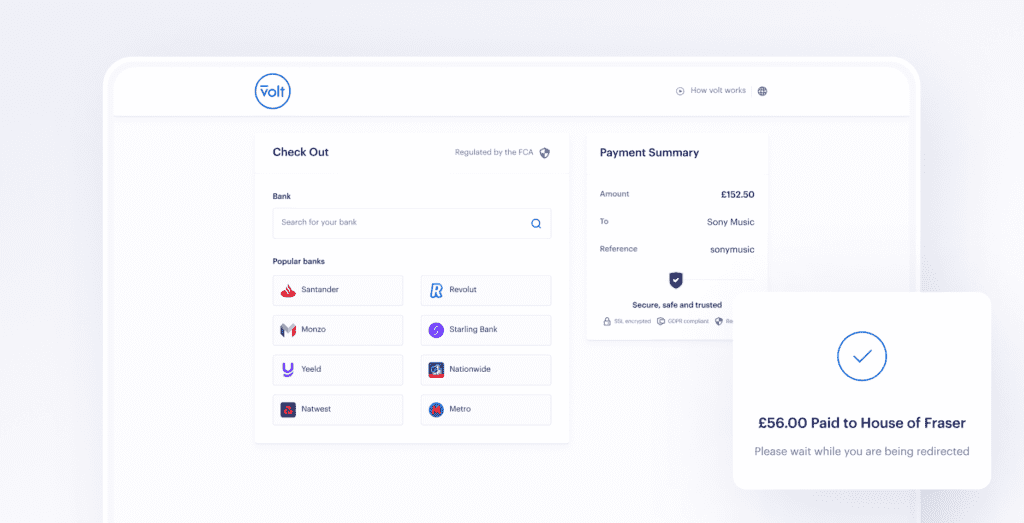

Our hosted checkout is the simplest solution to implement, requiring a single API call after authentication, where the payer chooses to use Volt’s Pay by Bank service on your website before you redirect them to a checkout page hosted by Volt.

Here, the payer can use our conversion-optimised bank search and input any other data that may be required in advance. They can also take advantage of our express checkout option and retain their bank information for future payments.

Tell us the bank to use

Our simplified experience relies on you to tell us which bank the payer would like to use, before you redirect them to Volt. We then display a clear confirmation page showing the details of the payment.

The Institutions API allows you to build your own user interface for the bank selection screen, giving you full control over the look and feel. Volt will provide an up-to-date list of banks with logos, icons and useful information on the name, search options and more for each one, to enable you to create a bank selector the way you want. You can then build logic on your side to decide if you want to show all the banks or just some of them. For full details review our integration docs here.

On either page

Once the payer has reviewed the details of the payment, they will be redirected to their online bank to authenticate and approve the payment. If the payer is using a mobile device and they have their bank’s app installed*, the app should open and they can login and approve the payment.

Some bank customers may need to provide additional details such as the account’s IBAN, a customer identification number, or a two-factor authentication code in order to proceed with the payment.

Returning the customer to you

Once the payment is complete, your customer will return to your website or mobile app.

* requires that the bank app is fully compatible with open banking payments.

Benefits of hosted checkout

- Minimal development required.

- Volt handles the entire payment flow, security, and compliance.

- Responsive design compatible with various devices.

- Continuous improvements and conversion optimisations based on Volt’s data, A/B test results, and industry best practices.

- Volt handles all countries, translations and both desktop & mobile specific flows.

Regional availability

The hosted checkout behaves slightly differently in each region to comply with local regulations and provide the best user experience. Below, we describe how hosted checkout operates in each region, along with considerations and market-specific features.

- 🇪🇺🇬🇧 European Union and United Kingdom

- 🇦🇺 Australia

The hosted checkout in the EU provides a seamless payment experience compliant with PSD2 regulations. Volt handles the entire payment flow, including bank selection, authentication, and payment confirmation.

Pros:

- Quick and easy integration.

- Volt manages compliance with PSD2 and GDPR.

- Supports multiple EU countries and languages.

- Continuous optimisation for higher conversion rates.

Cons:

- Limited customisation of the payment page compared to building your own UI.

- Redirects users away from your website during the payment process.

Considerations:

- Bank selection: Volt’s hosted checkout will handle the bank selection process.

- User experience: Payers will be redirected to their bank’s authentication page if required.

- Compliance: Ensure that you comply with GDPR when handling customer data.

Hosted integration coming soon

- On this page

- Hosted checkout

- Benefits of hosted checkout

- Different regions