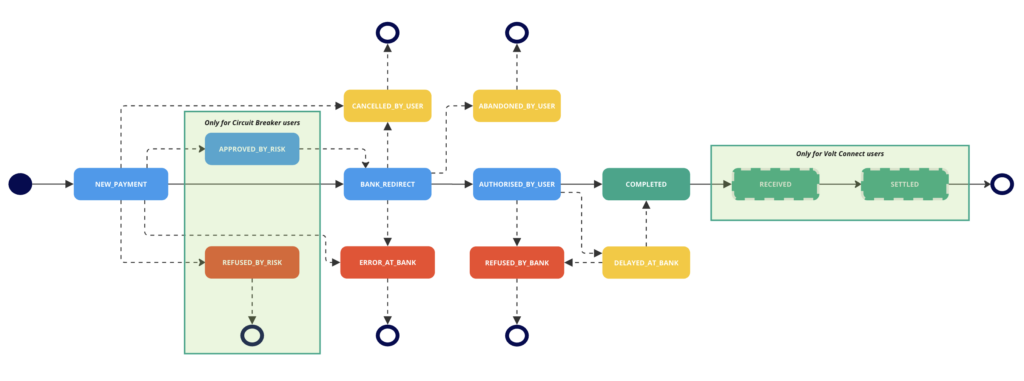

Payment status flow for Australia

We map all payment flows to the same set of statuses, regardless of which country you’re processing in – but you won’t need to handle every status in every country.

With PayTo in Australia, there are some statuses that will never occur. For example the NOT_RECEIVED status doesn’t exist in the PayTo flow because, due to the near-instant nature of the Australian NPP rails, a payment cannot be recalled once it has been sent.

The list of payment statuses below the flow diagram details the ones you should be prepared to handle in your system.

What the statuses mean

Below is a list of statuses that you need (and do not need) to process when integrating our PayTo payments solution for Australia.

| Detailed Status | Description |

|---|---|

REFUSED_BY_RISK |

Our fraud tool, Circuit Breaker, has analysed the transaction and decided not to sent to the bank for completion |

APPROVED_BY_RISK |

Circuit Breaker approved the transaction and sent it to the bank |

BANK_REDIRECT |

We are waiting for the shopper to authorise the PayTo agreement in their bank app or online banking. |

ADDITIONAL_AUTHORIZATION_REQUIRED |

Not used for PayTo. |

AUTHORISED_BY_USER |

The shopper has authorised the PayTo agreement at their bank. |

AWAITING_CHECKOUT_AUTHORIZATION |

Not used for PayTo. |

REFUSED_BY_BANK |

The bank refused to initiate the payment. This is typically a non-technical issue, for instance insufficient funds. In some cases the reason is not disclosed and can only be resolved by the shopper contacting their bank directly. |

ERROR_AT_BANK |

An error occurred after Volt requested the creation of a PayTo agreement at the shopper’s bank. |

DELAYED_AT_BANK |

The bank has responded that, although the payment has been approved, the funds have not yet been released. This can happen when a transaction was halted for some additional AML checks at the bank – which often happens with the first payment to a new merchant – or that the NPP or Bank has some temporary technical problems. The payment status will ultimately update to |

COMPLETED |

The payment has been successfully initiated at the bank. If you use Volt Connect, you will also get the |

NOT_RECEIVED |

Not used for PayTo. |

RECEIVEDonly for Volt Connect users |

Funds arrived on the merchant’s Volt Connect account. |

FAILED |

The payment request could not be completed due to technical limitations in the banking network. |

CANCELLED_BY_USER |

The shopper rejected the PayTo agreement during the authorisation at their bank. |

ABANDONED_BY_USER |

The shopper did not complete the agreement authorisation at their bank. Volt automatically sets this status 30 minutes from the moment we create the agreement. |

SETTLEDonly for Volt Connect users |

The funds have been transferred from the Volt Connect account to the merchant’s settlement bank account. |

- On this page

- What the statuses mean