Introducing payment initiation flow

The state of payment initiation flow is represented in the API responses in the paymentInitiationFlow object. This is the steering part of the integration, as this object tells exactly where the payer or payment is within the whole process, and what is required to finalise the flow.

{

// ...

"paymentInitiationFlow": {

"status": "PROCESSING",

"details": {

"reason": "AWAITING_USER_REDIRECT",

"redirect": {

"url": "https://vo.lt/AB1XF",

"directUrl": "https://myBank.com/authorisation?code=xyz"

}

}

}

}paymentInitiationObject describes status of the flow as well as provides optional details about next action to be taken by you or the payer.

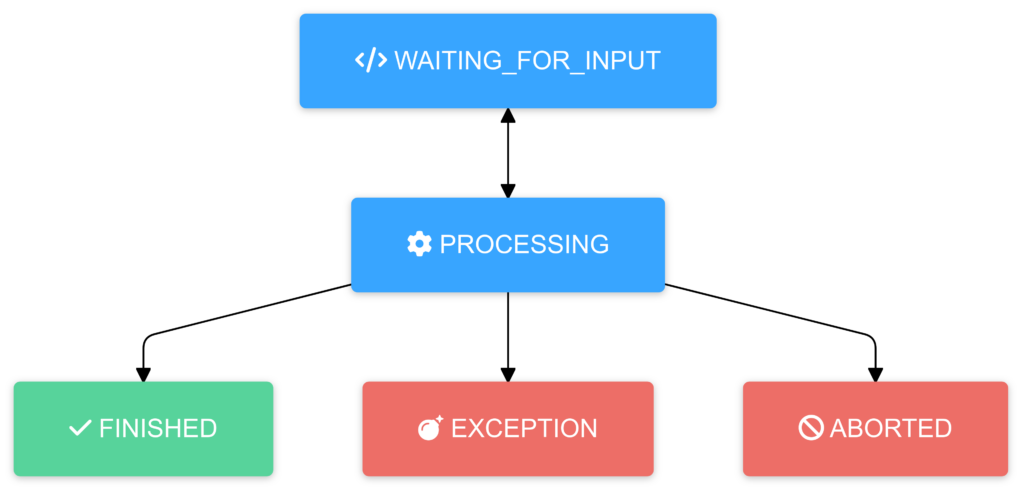

Initiation flow state machine

The payment initiation flow is governed by a state machine that manages the various stages and transitions during the payment process. Understanding this flow is essential for effectively managing payment statuses and guiding users through authorisation steps.

State machine overview

The payment initiation flow adheres to a simple state machine with the following statuses:

| Status | Description | Action required |

| WAITING_FOR_INPUT |

Volt is awaiting additional input from the partner via a |

Partner must provide the necessary input to proceed. |

| PROCESSING | The payment is being processed. This state may require the partner to redirect the user or continue polling for status updates. | Depending on the authorisation flow, partner may need to handle redirects or continue monitoring the payment status. |

| FINISHED |

The initiation flow has completed successfully. Note: |

Partner can consider the initiation process complete but may need to verify the actual payment status. |

| EXCEPTION | The initiation flow ended unexpectedly due to an issue. | Partner should handle the exception, possibly by notifying the user and logging the error for further investigation. |

| ABORTED | The payer either canceled or abandoned the authorisation process. | Partner may need to clean up any resources or notify the user about the aborted payment. |

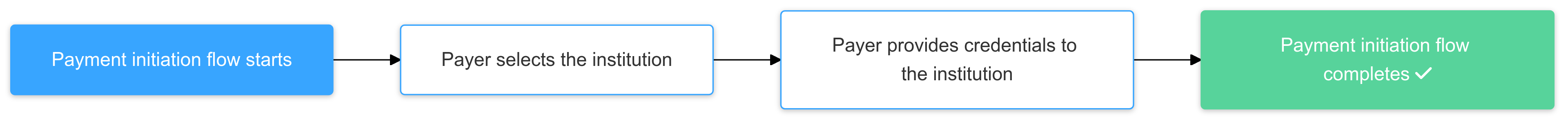

Authorisation flows

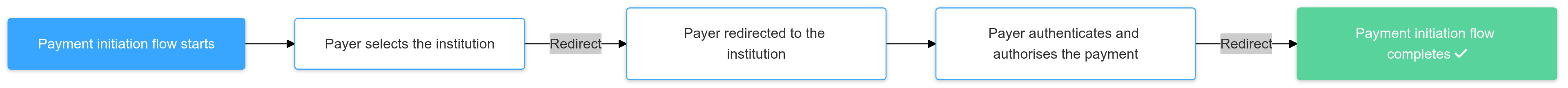

During payment initiation flow, the payer needs to authorise the payment. Institutions handle authorisation of the payment in few different ways:

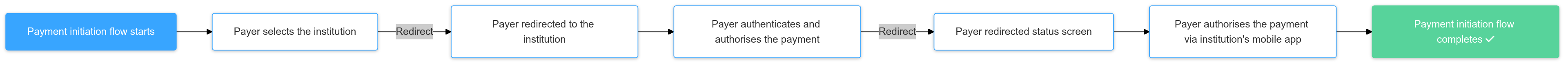

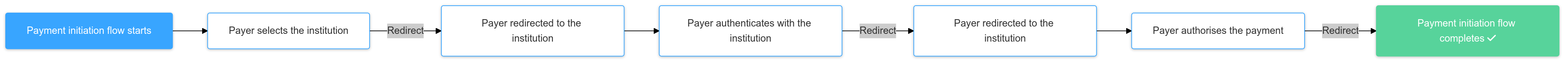

With the pre-authorisation flow authentication with the institution and authorisation of the payment are two separate steps. Usually, a payer is redirected to the institution UI to authenticate with the institution, and then is redirected to the institution UI again to authorise the payment.

With the embedded authorisation flow a payer’s credentials to the institution are captured by you or Volt, which are then used for authentication at the institution. There is no redirect to the institution.

All mentioned authorisation flows can include an additional step of authorisation, called decoupled.

With the decoupled authorisation the payer needs to authorise the payment through an additional form of authorisation provided by the institution, outside of the API integration (hence the name decoupled). Additional authorisation is done using whatever solution institution supports. In most scenarios it is done via the institution’s application installed on mobile phone.