Australian real-time payments

Australia’s payment sector is rapidly expanding, integrating best practices from around the world to build their New Payments Platform (NPP), designed to be real-time by default.

Volt’s advanced payments platform is based on the NPP’s PayTo® payment scheme, and is a prime opportunity for all merchants to tap into millions of new Australian customers.

What is PayTo®?

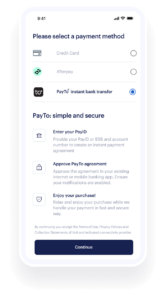

PayTo is a modern digital payment solution developed in Australia, offering a fast, easy and secure way to pay. It gives consumers more visibility and control over their payments, and enables merchants and businesses to initiate real-time payments from their customers’ bank accounts.

Launched in 2023, it is quickly becoming a popular choice for payments, facilitating real-time 24/7 merchant-initiated transactions, even on weekends and holidays.

PayTo can also support recurring transactions, Supporting single and recurring payments using the same integration, PayTo is set to revolutionise the way Australians pay – from e-commerce to point of sale. Don’t miss out on the chance to be part of this thriving market; partner with Volt for a seamless integration experience!

The key features of PayTo

- Real-time account validation – when a PayTo agreement is created, the account is validated in real-time, reducing errors and exception processing.

- Real-time funds verification – at the time a payment is initiated, available funds are verified to ensure the payment can be made.

- Easy reconciliation – PayTo agreements contain additional information and data to support easy matching and reconciliation.

- Supported by APIs – working with your financial institution or payment service provider, PayTo can be supported by APIs to deliver a seamless process.

- Notifications at each stage of a payment – notifications when an agreement is paused, changed or cancelled will help your business maintain customer relationships.

- Free of charge for shoppers – PayTo is shopper-friendly, with no fees for the shopper – offer Volt’s Pay by Bank as your no-cost option when using dynamic surcharging for your card payments.

More about PayTo can be found on the official website: https://payto.com.au/

PayTo® FAQs

Are there any chargebacks using PayTo?

No, PayTo is a realtime payment scheme where payments are authorised at the shopper’s bank. Once a payment is authorised and sent, it cannot be recalled. Because all payments are authorised, the chances of a dispute being raised are minimal. If you need to return a payment to your shopper, you can use the refund facilities provided by Volt’s solution, using our API or via our merchant portal, Fuzebox.

Do all banks support PayTo?

All the major banks in Australia support PayTo, covering the majority of the population. Some smaller regional banks do not yet have PayTo capabilities, however these account for a fractional market share.

- On this page

- Australian real-time payments

- PayTo® FAQs