Volt’s shopper experience

The Australian Volt checkout experience is one of the easiest processes for the shopper to navigate. There’s no bank selection, just a simple PayID field to complete. Authorisation is done in the shopper’s bank app or online banking portal, safe in the knowledge that the security around their payment is bank grade.

The Australian Volt checkout experience is one of the easiest processes for the shopper to navigate. There’s no bank selection, just a simple PayID field to complete. Authorisation is done in the shopper’s bank app or online banking portal, safe in the knowledge that the security around their payment is bank grade.

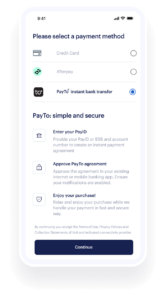

- The shopper chooses PayTo® Instant Bank Transfer at checkout.

- The shopper enters their PayID® (or BSB and an account number if they don’t yet have a PayID).

- A one-off payment agreement is automatically generated, based on the transaction amount.

- The shopper then simply approves the agreement using their mobile bank app or online banking platform. This will usually involve some kind of biometric or two-factor authentication.

Once approved, the funds are instantly transferred to Volt’s account. Each transaction is assigned a unique ID for easy reconciliation.

One-click payments

For our Australian shoppers, we have introduced a feature called one-click payments, which allows the shopper to approve a payment agreement for recurring payments. This feature speeds up and simplifies the checkout process for returning shoppers. We use the shopper reference to initiate payments authorised by Volt, without needing to approve agreements again in their bank.

How it works

-

One-click payments: Shoppers can opt-in to save their payment details for future transactions. Once the shopper has approved the initial payment agreement, future transactions can be completed with a single click. The initial payment agreement allows for making recurring transactions.

-

Returning shopper identification: We use the

shopper.referencefield to identify returning shoppers. If the shopper is recognised based on theshopper.reference, they will see their details already filled out in Volt Checkout and can proceed with a one-click. -

Data Storage and security: All necessary payment details, such as account numbers and bank codes, are securely stored on our servers. This data is only used for payments to the original merchant, ensuring privacy and security.

By implementing one-click payments, Volt aims to provide a seamless and efficient checkout experience for returning shoppers in Australia, reducing the need for repeated approval processes and enhancing overall user satisfaction.

- On this page

- The Volt shopper experience